Self-Employed? Here's How Schedule-C Taxes Work

Are you a self-employed entrepreneur? Do you get a 1099, own a Single Member LLC, and file a Schedule C tax return? This video post covers the critical self-employed tax basics to keep you in good graces of the IRS.

WAIT! Let’s start with the basics of how How Taxes Work for self-employed or Schedule C earners.

Do You Have a Schedule C?

Do you earn income as a 1099 contractor?

Earn income as a sole-proprietor?

Have a single member LLC (SMLLC)?

You will have to file a “Schedule C” with your individual tax return.

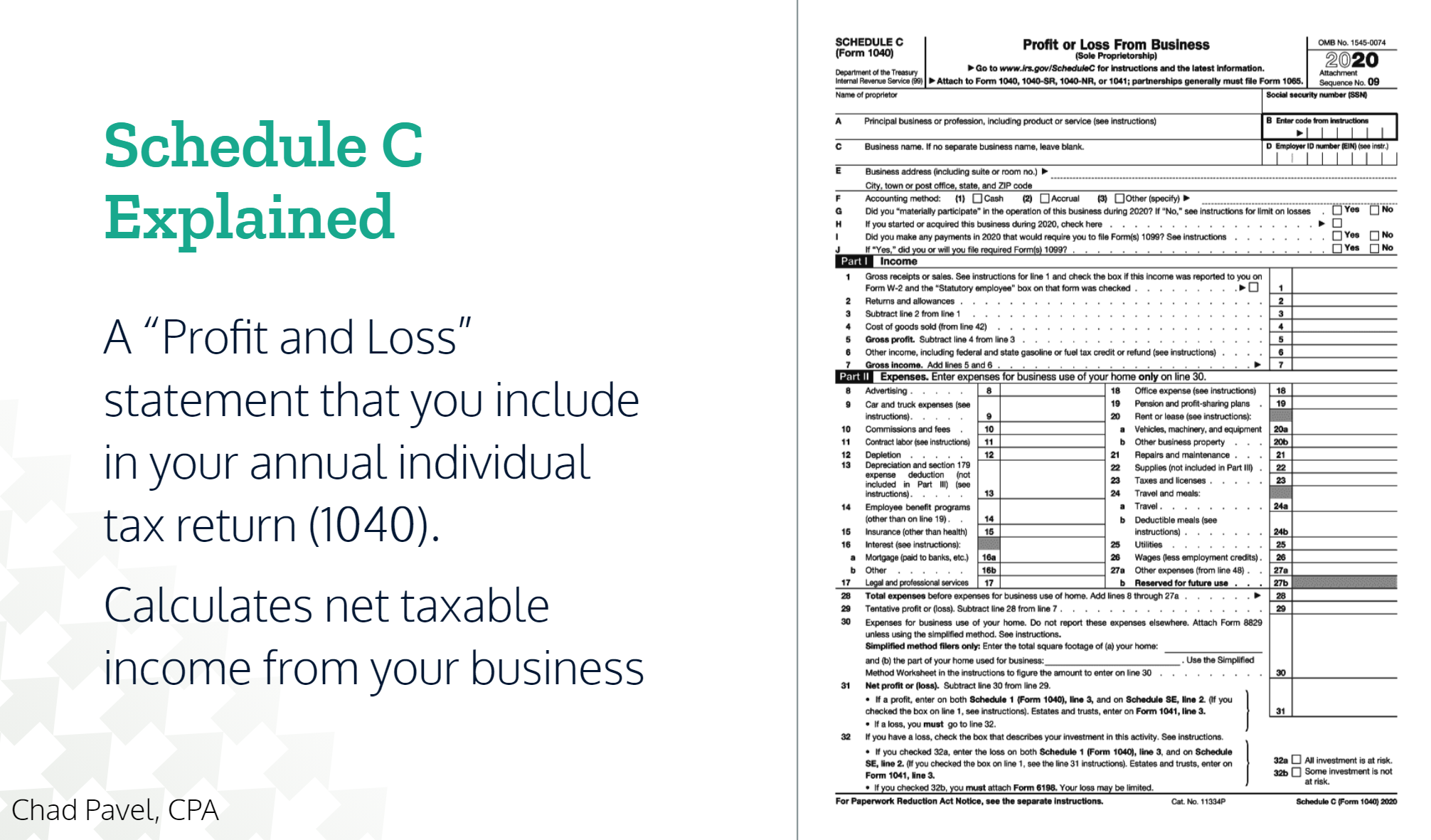

What is a Schedule C?

The Schedule C is the “Profit and Loss” statement that you include in your annual individual tax return (1040) that you file each year.

It calculates net taxable income from your business based on your accounting records and generates an income number that shows up on your individual or joint tax return.

WAIT! Here’s How Taxes Work

As a quick reminder of how taxes for for self-employed professionals, here is a quick summary as well.

You only pay tax on your business’s net income

You pay TWO types of taxes as a self-employed

Income Tax (on your profits)

Self-Employment Taxes (15.3% of ALL profits)

You do NOT pay additional taxes on distributions

You SHOULD pay estimated taxes (each quarter)

You file ONE tax return per YEAR (Schedule C, on your 1040)

How Do I Pay Myself?

First, you’ll want to open a business bank account and keep all business activity within that account.

Collect all sales revenue into your biz bank acct

Pay yourself out of your profits (enough cash)

Write a check / transfer to personal account

NO W-2 paycheck (no payroll required)

Ideally, pay yourself a set amount each week/mo.

Pay yourself extra when you have profits

Watch out for estimated taxes!

Creating a Schedule C From Accounting Records

Take Your Quickbooks / Xero Profit and Loss

Cash Basis

Each Year

Input the data into your Schedule C on your tax return

How to Prepare a Schedule C

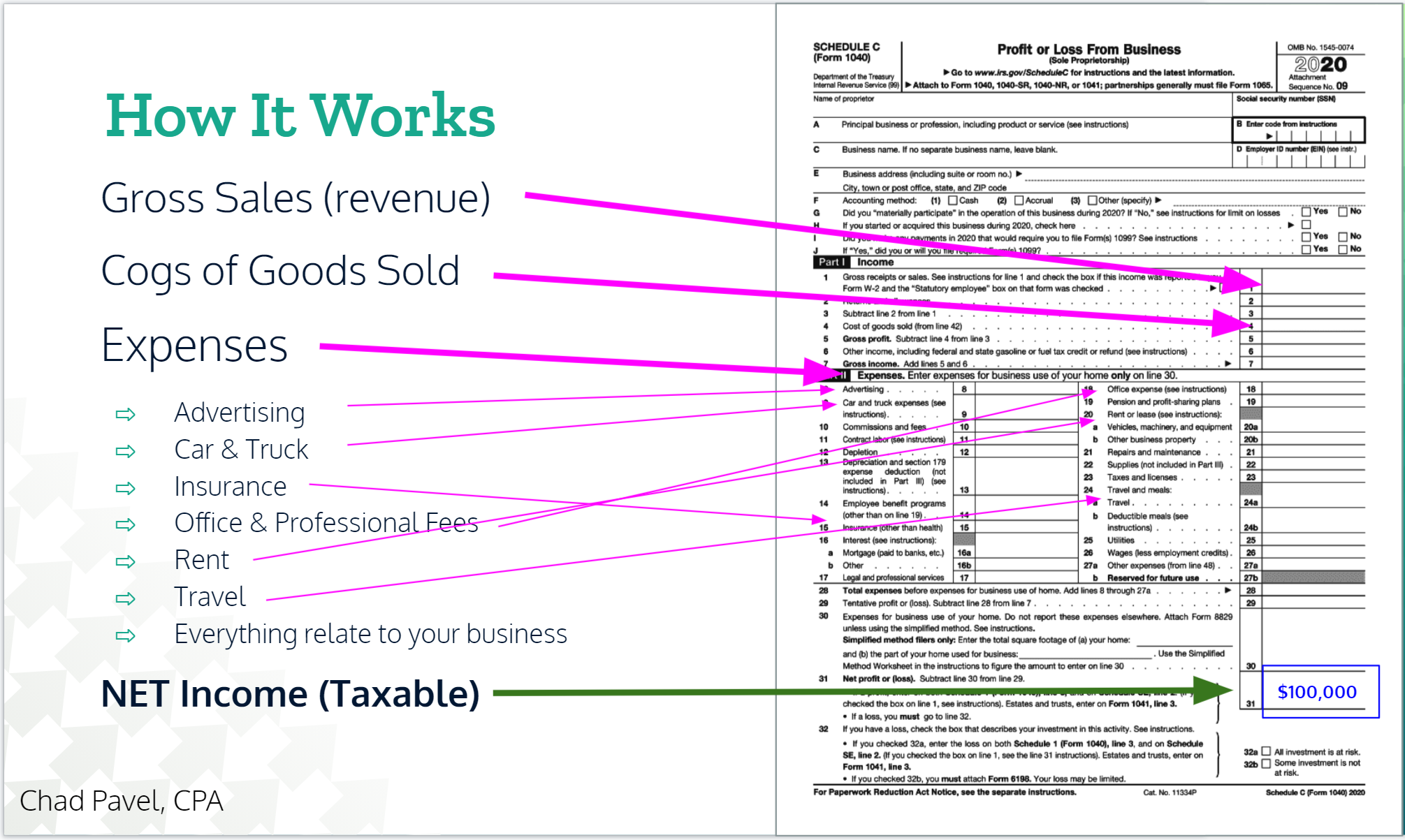

Gross Sales (revenue)

Cogs of Goods Sold

Expenses

Advertising

Car & Truck

Insurance

Office & Professional Fees

Rent

Travel

Everything relate to your business

NET Income (Taxable)

Report Schedule C Net Income on Your 1040

How Your 1040 Tax Return Flows Together

W-2 wages

Interest/Dividends

Capital Gains

Business Income

Deductions & Adj

Itemized/Standard

Deductions

Tax Credits

QBI deduction

= TAXABLE INCOME