How to Find the Perfect Small Business CFO

How to Find the Perfect Small Business CFO

Are you looking for a CFO for your startup or your small business? Do you have big plans to raise capital, get acquisition financing, and bring your firm to the next level? In this post, we will help you discover how to evaluate your various CFO options and help you find the perfect fractional CFO for your business.

Summary:

What exactly is a Small Business CFO?

CFO Salaries and Costs

How to Find and Hire a Fractional Small Business CFO

What Exactly is a Small Business CFO?

The concept of the small business CFO has been growing in popularity over the last 10 to 20 years. In the past, only big, funded, and profitable businesses hired full-time CFOs to help them execute their largest initiatives. These CFOs were full-time employees, earning full-time paychecks, and making deeply involved decisions acting as part of the management team.

However, the increasingly complex business world and the rise of virtual work has created a new breed of CFO to serve small businesses around the world.

The small business CFO is typically not a full-time employee, works on a consulting or part-time basis, and many times acts as more of a strategic consultant to the CEO and its investors, versus the Chief Accountant like years past.

The small business CFO has a number of different names and titles, including:

Virtual CFO

Fractional CFO

Interim CFO

CFO for Hire

CFO Advisor

CFO Consultant

You have probably seen a number of other titles for the small business CFO too.

In any case, the small business CFO is often a part-time, outside advisor, who works with the CEO, investors, and board of directors as an extension of their team, who guides, leads, mentors, and provides outside expertise to the business to help it perform at a higher level than it can on its own.

The CFO is also responsible for more than just accounting and finance in many cases and also leads teams within HR, IT, Sales, Acquisitions, Marketing, Support, and more.

CFO Salaries and Costs

One of the primary reasons that the small business CFO, or fractional CFO position, was created in the first place, is due to cost considerations.

CFOs are some of the highest-paid executives across all industries and all sizes of business, yet quite frankly, their services are not always needed on a full-time basis for many, if not most, small businesses.

So if a small business needs CFO services, but, does not have the budget to hire a full-time CFO for their business, the only logical option is to hire a fractional CFO to guide the company on a part-time basis.

Full-time CFO Costs

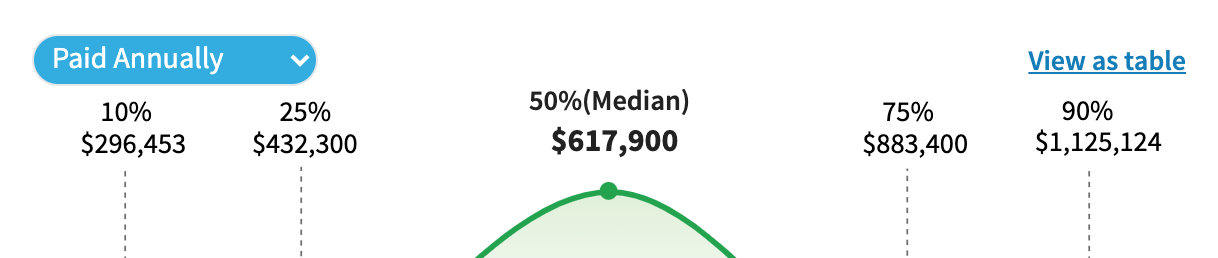

CFO salaries and costs are simply...quite expensive. In Stamford, CT, for example, a CFO’s full-time salary + bonus average is a whopping $617,900! Even if you live in a less expensive area, can your small business afford to pay a CFO this month?

As you can see, the average CFO will cost your business more than $50,000 per month in salary, taxes, benefits, and overhead if you choose to hire a full-time CFO.

Fractional Small Business CFO Costs

A small business CFO is typically paid on an hourly, daily, or monthly basis and in almost all circumstances, should cost the business less than $50,000 per month.

Some example rates of CFOs that we have seen in the small business marketplace include:

Hourly rates of $200 to $300 per hour

Weekly rates of $1,000 to $2,000 per week

Monthly rates of $3,000 to $10,000 per month

For short-term projects, a CFO will typically work on an hourly basis and on occasion work on a fixed-fee project basis.

For ongoing advisory engagements that have a regular meeting schedule and rather predictable time allocation, a weekly or monthly engagement fee may be more appropriate and popular.

At our firm, we typically work on an hourly basis with our clients for undefined, short-term projects, and strive towards a flat-weekly basis arrangement for our clients who have a regular and dependable schedule, a rather defined time allocation, and we build in a number of hours to account for the project and “anytime” hours as well.

In general, our arrangements fall into the ranges of fees and rates noted above, and after comparing our engagements to our competitors, we are right in line with the marketplace.

How to Find and Hire a Fractional Small Business CFO

If you are convinced that you need a CFO to lead your small business and your startup, here are some things to consider and questions to ask when you meet with your future potential CFO.

Relevant Industry Experience: One of the most important items to consider is whether or not your CFO has experience working in your industry. This way, you can rest assured that they understand the metrics, benchmarks, business lingo, vendors, software, and general operations and can hit the ground running when you engage them. Otherwise, you may find that you are spending too much time teaching your new CFO about your business.

Skills Matched to Your Needs: While you may not be 100% clear on which services you need your CFO to provide for your business, you should have an idea of which areas you need help with. For example, if you need help with accounting systems and monthly close, you may want a CFO who has prior experience as a controller or chief accounting officer. If you need help with raising capital from private equity and buying companies for strategic growth, you will want to pursue a CFO who has corporate finance or investment banking experience. Match the skills to your needs.

Rapport: Naturally, you will want to pick a CFO who you actually enjoy working with, will be tolerable, even enjoyable to work with, and who you can see yourself partnering with for the long run. Unless you want a mercenary to get deals done at any expense, you will want to work with a person who you enjoy.

Small Business CFO Summary

We hope this guide will help you in your search for the perfect small business or startup CFO to help you grow. Whether you need help getting your business started, raising capital, obtaining business acquisition financing, a small business CFO can be your ticket towards higher profits and valuation, and growing the business of your dreams.

If you would like to discuss Pinewood’s small business CFO services, let’s set up a time to talk here.

~ Chad Pavel, CPA